The Old Year – Old-Year (Example – 2021)

The New Year – New-Year (Example – 2022)

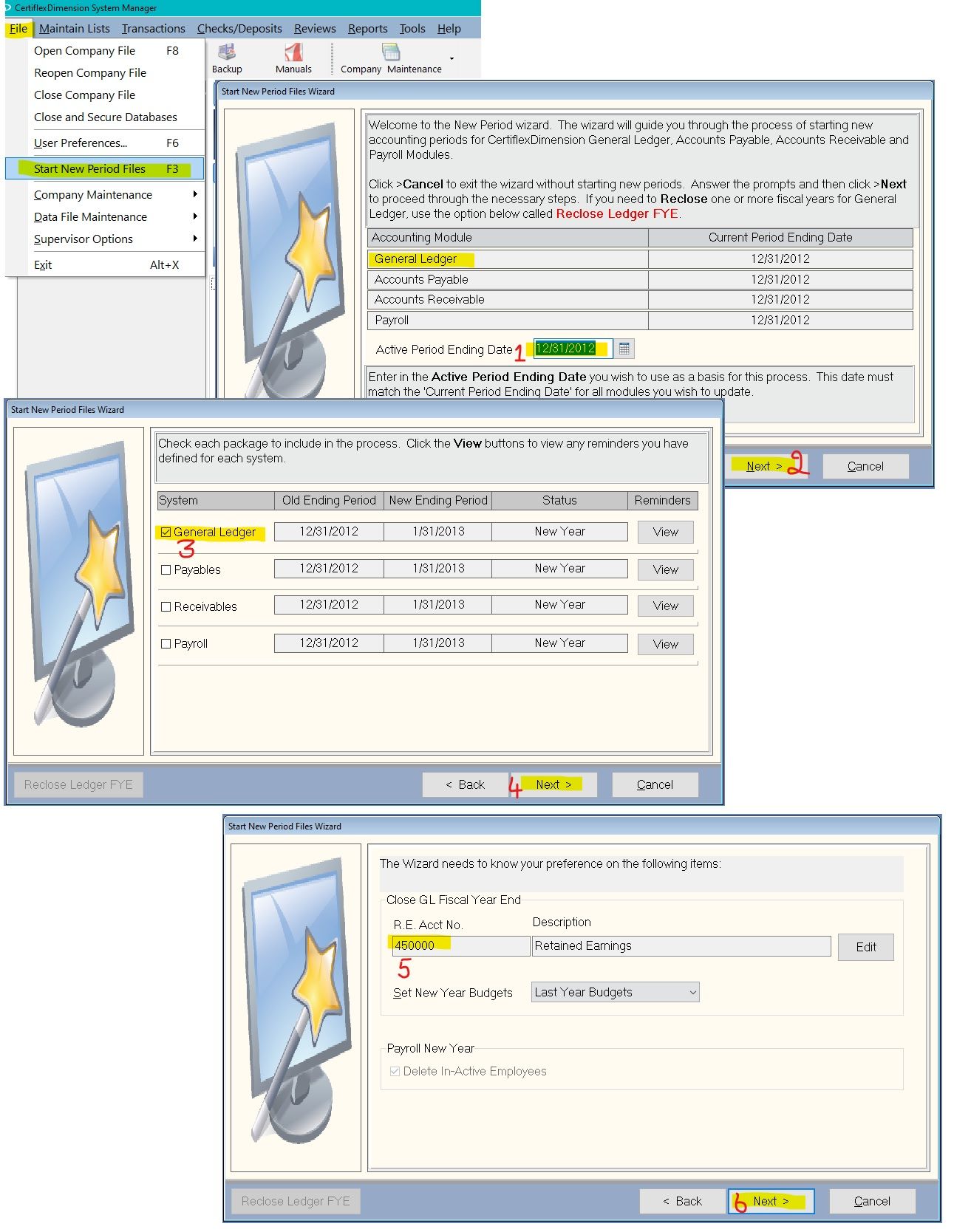

The following procedure assumes a fiscal year-end of December 31. To begin a fiscal year-end close, change the system date to December 31, Old-Year. To close a year in CertiflexDimension Ultra from the system manager, click >File>Start New Period Files or press F3.

General Ledger has the most flexible fiscal year-end procedure of all CertiflexDimension Ultra accounting modules. You can start new General Ledger fiscal year files on the first day of the new year because General Ledger allows you to re-close a year at any time. During a fiscal year-end closing, the system will prompt you for the retained earnings account to use for closing all revenue and expense accounts. The system will then create New-Year General Ledger files. You can now begin processing New-Year data simply by changing the system date to the January New-Year.

Most businesses will require making adjusting entries in General Ledger for December Old-Year after processing in January New-Year. To make adjusting entries, change the system date to December Old-Year and make the entries as required.

To reflect adjusting entries in New-Year, re-close Old-Year files with a system date of December Old-Year. The system will recognize the closing as a re-close and automatically update the adjustments to all periods of New-Year. Because the system never permanently closes a General Ledger year, you can re-close as often as needed.

(For larger Image: right-click-image & open in new tab)