The Old Year – Old-Year (Example – 2021)

The New Year – New-Year (Example – 2022)

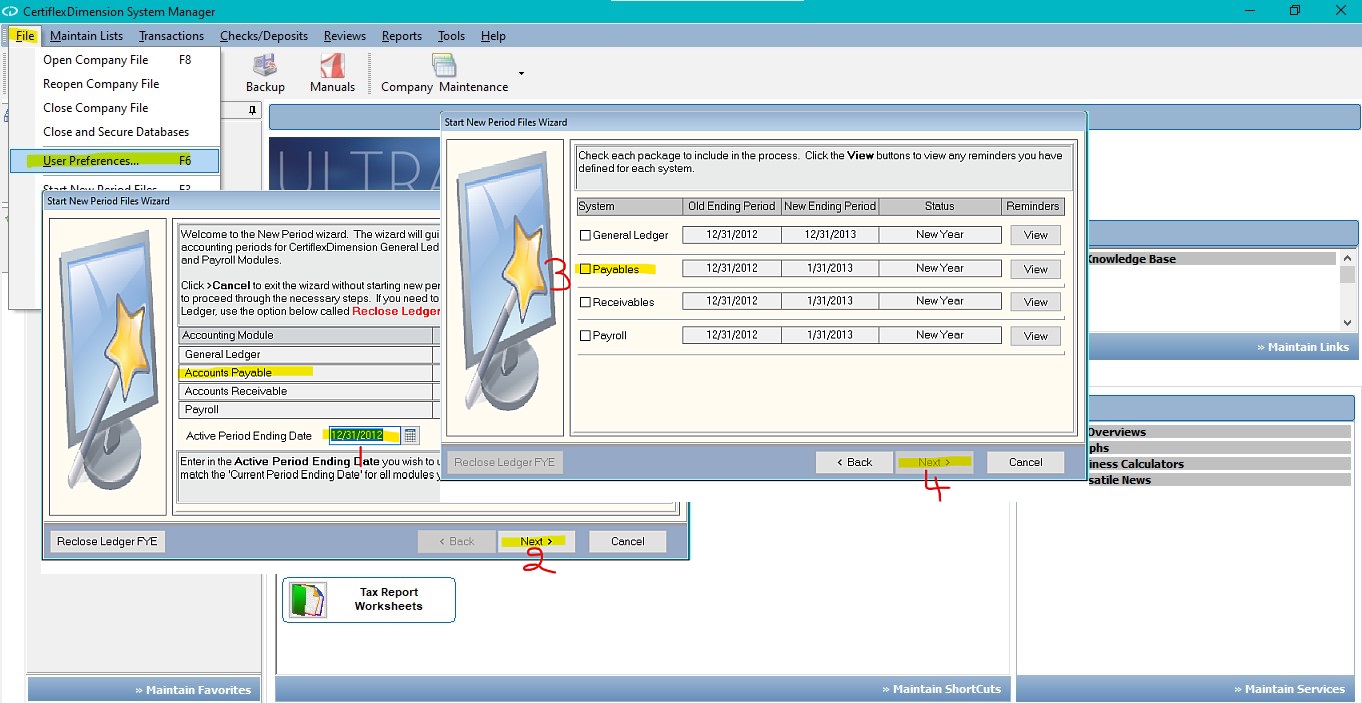

The following procedure assumes a fiscal year-end of December 31. To begin a fiscal year-end close, change the system date to December 31, Old-Year. To perform a closing in CertiflexDimension Ultra from the System Manager, click >File>Start New Period Files or press F3.

New vendor files for New-Year must be created before vendor invoices or checks can be processed in New-Year. During this process, the Historical Aged Payable Reports for January through November of the Old-Year will be deleted. Therefore, it is recommended that you make a printed copy of these reports prior to beginning. To access Form 1099 information for Old-Year after you have created New-Year files, set the system date to December Old-Year. Accounts Payable allows vouchering in December Old-Year, even after creating vendor files for New-Year, by setting the system date to December Old-Year and vouchering as normal. The system will detect invoices being processed across the fiscal year-end and add them to Old-Year and New-Year vendor files. If interactive with General Ledger, GL files for Old-Year will be updated. You must re-close GL to reflect those entries in New-Year General Ledger.

(For larger Image: right-click-image & open in new tab)