Q: How do I reverse a payment entry posted to the wrong month or customer, but still retain invoice details in my aged receivables?

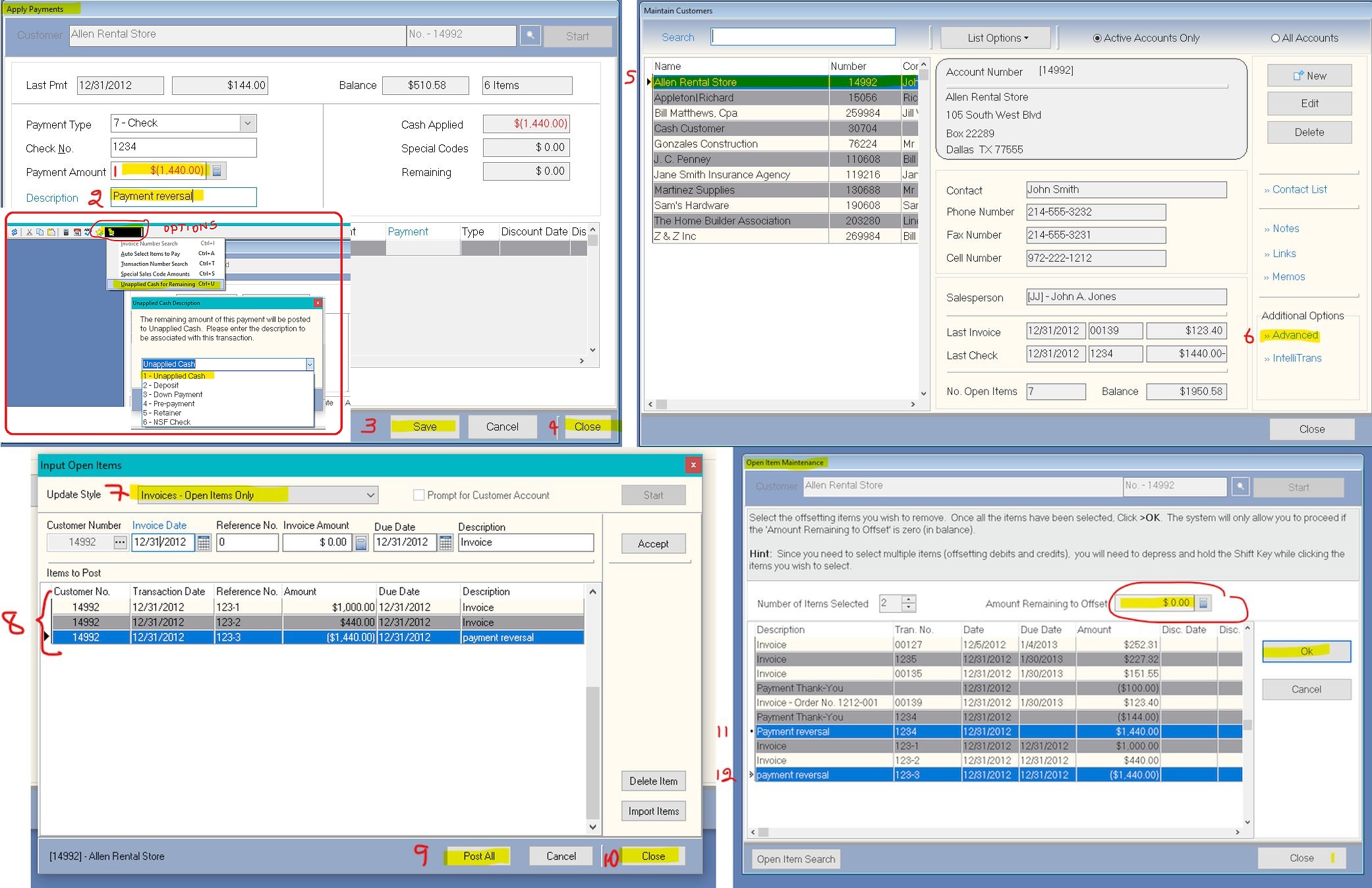

A: The first thing you do is make a back-up by clicking on the BackUp icon on the main Certiflex window, then go to >Transactions >Accounts receivable >Apply Payments select the customer in question and press >Start. Next, select the Payment type (e.g. 7-Check), and enter the Reference No. Enter the Payment Amount as a NEGATIVE value. In the Description field, enter a relevant description and press ENTER. From the Options menu located at the top of the window, select Unapplied Cash For Remaining and from the following drop-down menu select Unapplied Cash. Press >Save, and >Close.

Next got to >Maintain Lists >Accounts Receivable >Customers, highlight the customer in question and click on Advanced on the lower right-hand corner of the window. Next, click on Input Open Items then, from the Update Style menu, select Invoices – Open Items Only. Click the Start button and re-enter the invoices that were removed when the payment you are reversing was made. The total of these invoices must equal the negative payment you made earlier. Finally, make one more entry equal to the negative payment amount. This entry MUST be entered as a NEGATIVE amount. Once you are done, click the Post All button, and Close.

Finally go to >Transactions >Accounts Receivables >Open Item Maintenance select the customer and click Start. In the following window, click Remove. While holding down the CTRL key, double-click on the negative open item entry you created through the Input Open Items option, and the entry that was created when you made the negative payment. At this point, the Amount Remaining to Offset field should have a zero value. Now click the OK button.

If you now review the customer’s record, as well as the Aged Receivables report with the Print Detailed Report option selected, you will see the open items will appear as expected.

(For larger Image: right-click-image & open in new tab)