Q: How Can I create the setting for the 401K deduction part not to deduct federal income tax withholding?

A: Unlike earnings codes that are fully taxable, special tax codes such as the 401K deduction may be adjusted to be exempt from certain taxes. Special codes can also be coded not to affect the employee’s net check (Tips or Fringe Benefits).

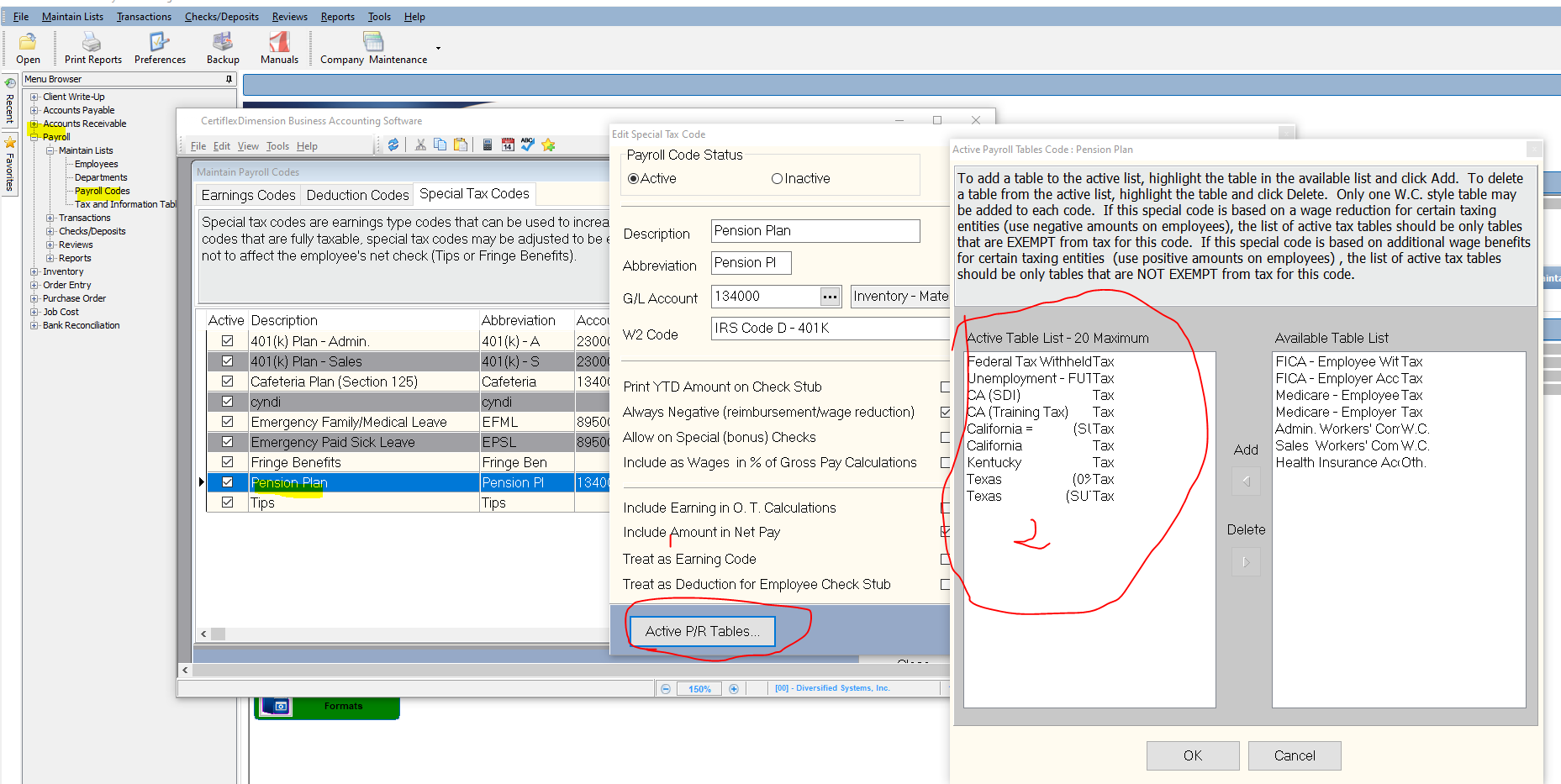

To adjust the setting for the 401K, go to >Payroll>Payroll Codes. Select the Special Tax Code you want to adjust, for example 401K, then click Edit. Next, click on Active P/R Tables

To add a table to the active list, highlight the table in the available list and click Add. To delete a table from the active list, highlight the table and click Delete. Only one W.C. style table may be added to each code. If this special code is based on a wage reduction for certain taxing entities (use negative amounts on employees), the list of active tax tables should be only tables that are EXEMPT from tax for this code. If this special code is based on additional wage benefits for certain taxing entities (use positive amounts on employees), the list of active tax tables should be only tables that are NOT EXEMPT from tax for this code.

(For larger Image: right-click-image & open in new tab)