Q: I have employees with a 401(k) Special Tax Code that is set up to withhold a fixed amount each pay period. The code is not set up to stop withholding when it reaches a certain balance. However, at a certain point this fixed amount stopped being withheld from the check, as if it had reached a predetermined limit. What could be causing this?

A: If the 401(k) Special Tax Code is tied to an employer’s matching tax table, that matching table may have been create with a specific Total Year-to-Date Contribution Limit amount. This will affect the withholding amounts as described above.

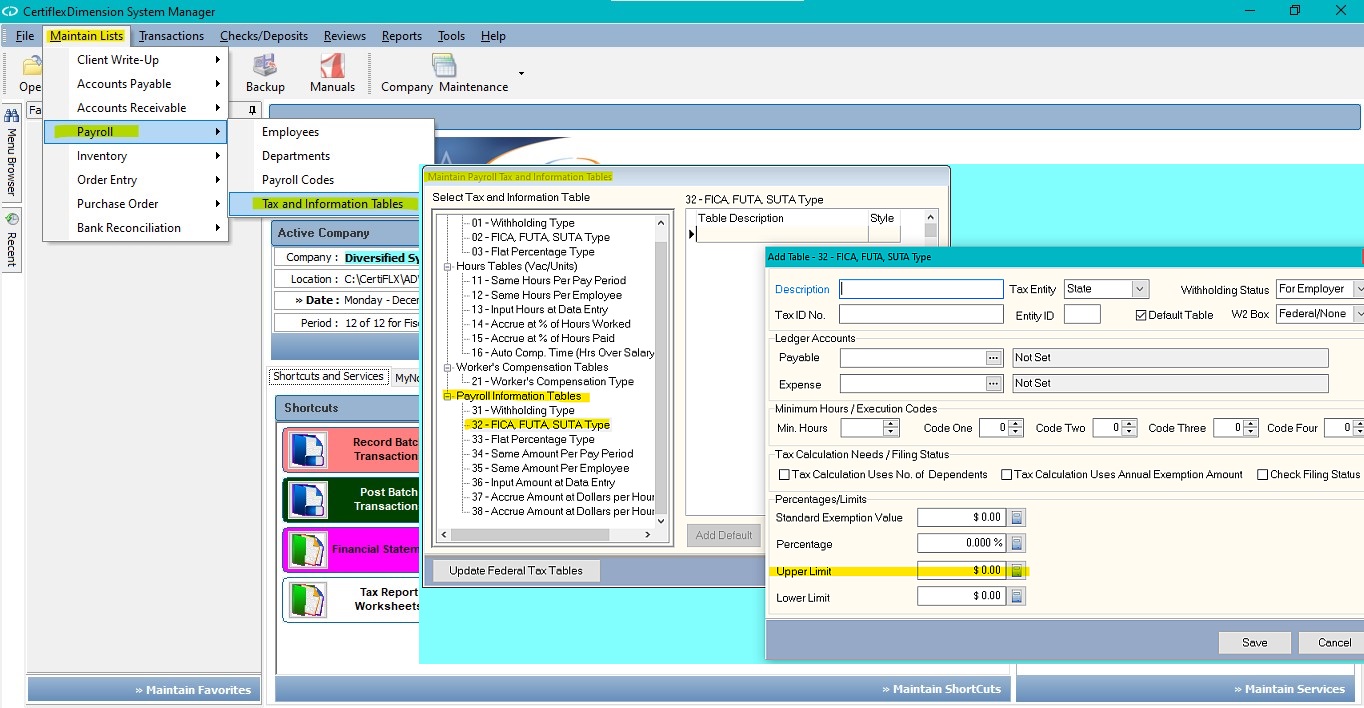

To review or edit the amount of the employer’s matching table contribution limit, go to >Payroll >Maintain Lists >Tax and Information Tables. Under Payroll Information Tables, select type 32 – FICA, FUTA, SUTA Type. To the right will be a list of tables, including the employer matching table that is tied to your 401(k) code. If the matching table was created during the setup of the 401(k) code the system will have named the matching table accordingly. For example, if you named the 401(k) code 401K PENSION, the name of the employer’s matching table will be Employer’s Matching – 401K PENSION.

(For larger Image: right-click-image & open in new tab)