Q: How long should I keep my payroll records?

A: The IRS requires that payroll records must be kept for four years after the tax due date, or the actual date paid. However, state and Social Security Administration requirements may differ.

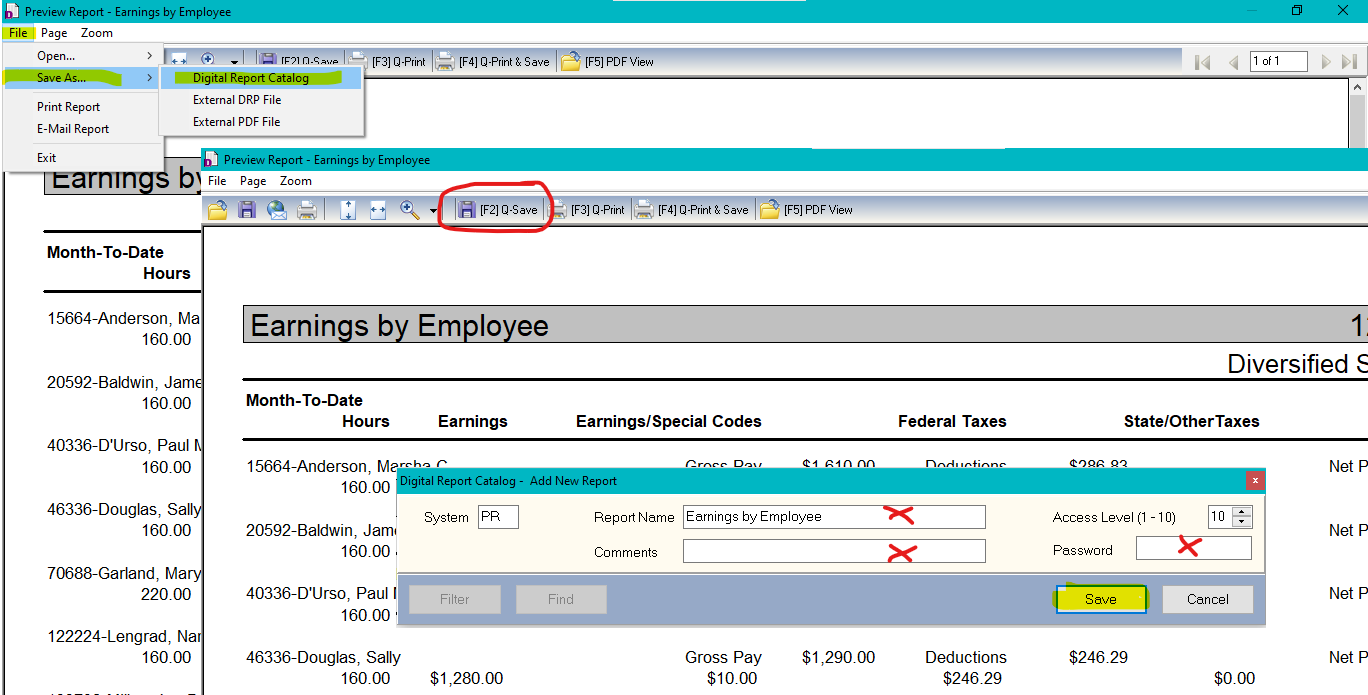

A quick and easy way to archive your payroll records is to use the Digital Report Catalog. This can be done for nearly every report generated in CertiflexDimension Ultra. Go to the Reports program and select a report as you normally would. Instead of sending the report to the printer, choose Preview/Digital File as your “Report Output.” Click >Print and the report will print to screen. In the upper left corner, click >File >Save As >Digital Report Catalog, or Alternatively, click on the quick save icon F2. The Add New Report window will appear, allowing you to rename the report, add comments, and set a password and access level. Click >Save and a digital copy of the report will be archived in the Report Catalog.

To access the Digital Report Catalog, open the Reports program and click on the “Open Saved Report…” button.

(For larger Image: right-click-image & open in new tab)