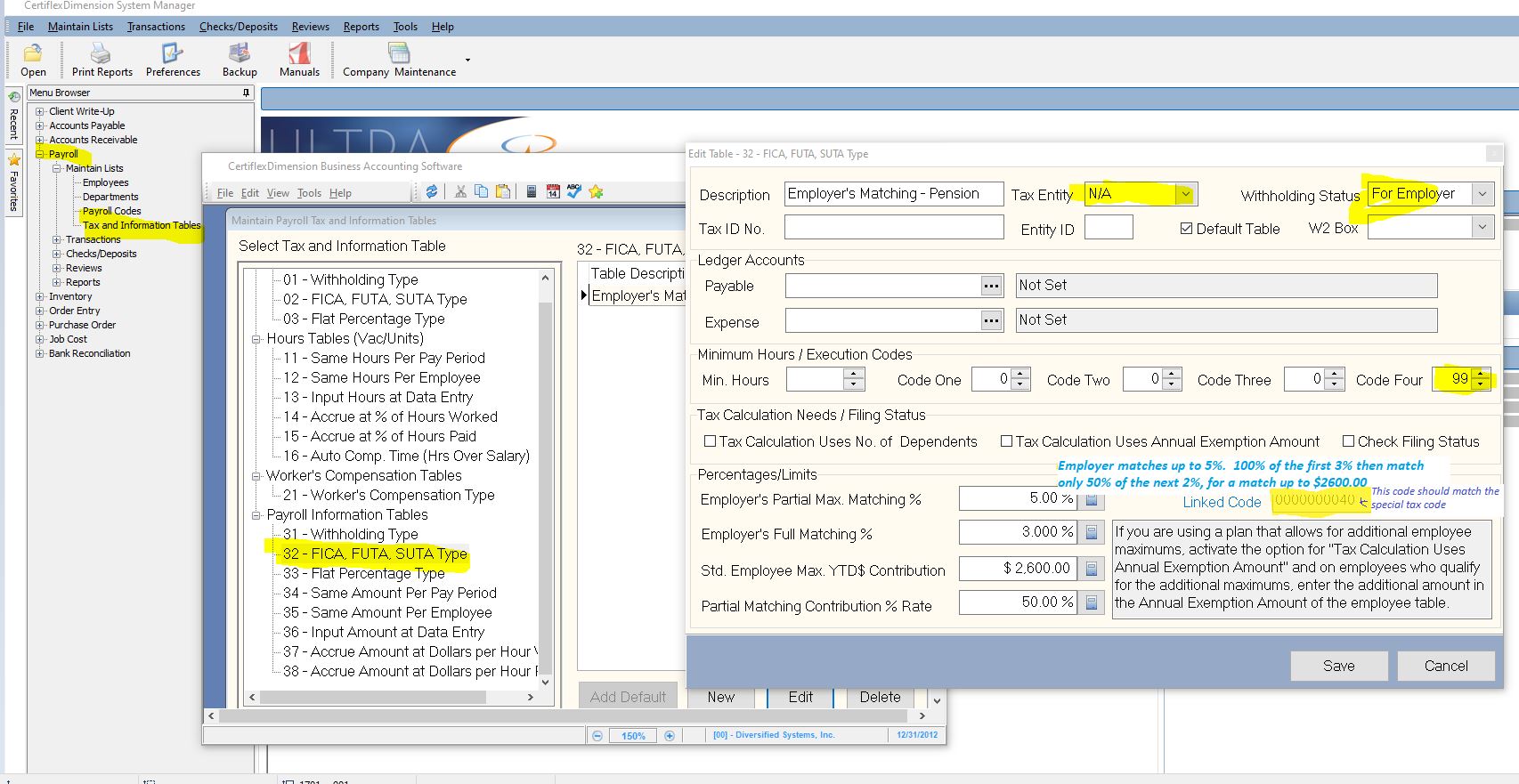

Q: How do I set up an employer’s matching pension for 401K?

A: The Style-32 (FICA/FUTA/SUTA ) table can be used to set up employer’s matching pension. This style of table uses flat percent calculations with support of upper and lower limits. Most federal and state unemployment tables are included in this sub-topic. You may also set this style to enable an employer matching type table that can be linked to a special tax code for pension plans (Code 4=99, and Link=Special Code Tracking Number). When the table is set up as an Employer’s Matching Pension table, you have the option of setting up a Safe Harbor style pension plan. This will allow you to set limits for partial and full matching employee contributions. If the table is an employer matching pension plan, you will receive the following prompts:

- Employer’s Partial Max. Matching: Enter the percentage limit where

the employer will partially match the employee contribution to the

pension plan. - Employer’s Full Matching %: Enter the percentage limit where the

employer will fully match the employee’s contribution to the pension

plan. - Std. Employee Max YTD$ Contribution: Enter the maximum

contribution per year that the employee can make to the pension plan

in order to receive a matching contribution from the employer. - Partial Matching Contribution % Rate: Enter the percentage of the

employee contribution that the employer will match when a partial

matching contribution is required. For example, if the employer will

match half of the contribution up to 5%, you should enter 50% in this

field.

(For larger Image: right-click-image & open in new tab)