Q: How do I add a table for an employer matching savings plan to an already existing code?

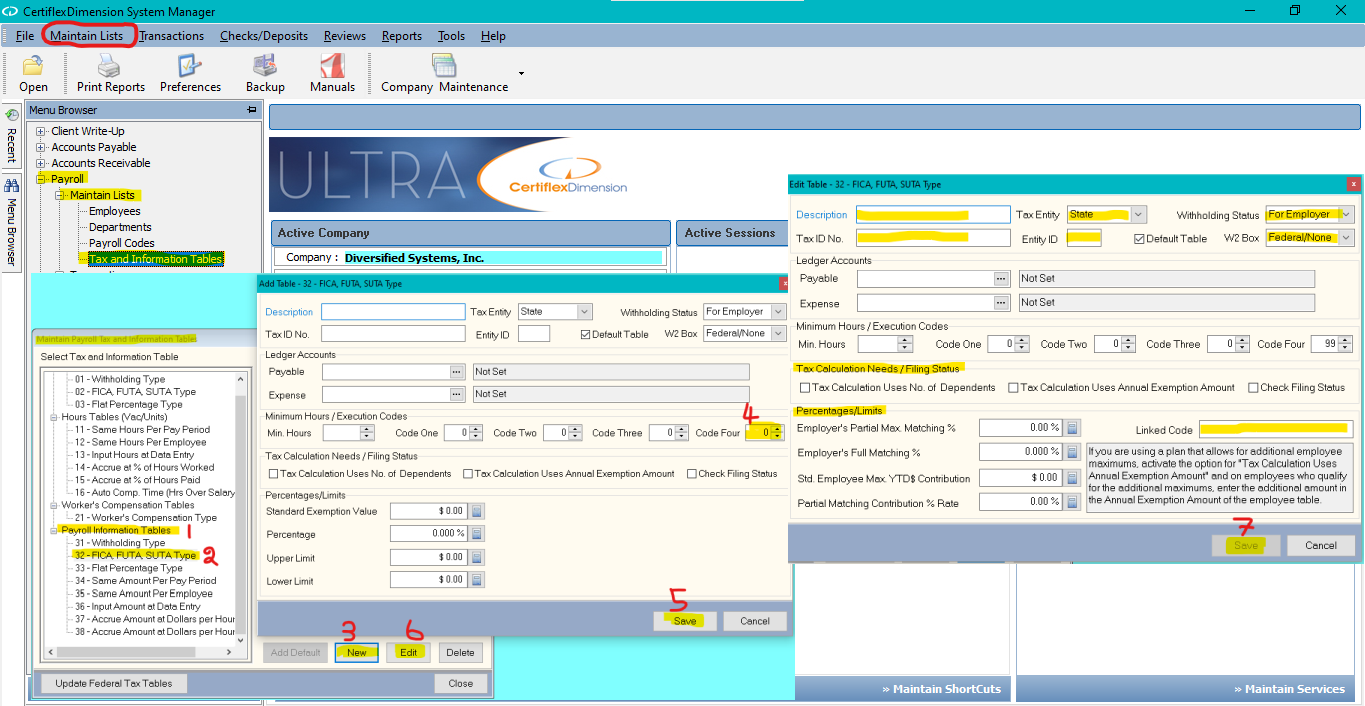

A: First you’ll want to take note of the existing code’s tax ID number, later referred to as the Linked Code. Go to >Maintain Lists >Payroll >Tax and Information Tables. Select the existing table that you want to match and click Edit to view its properties. Make note of this table’s tax ID number.

Now you’ll create your new matching table. Select >Payroll Information Tables> 32 – FICA/FUTA/SUTA . Click New to create the new matching table.

The window that opens will not automatically set itself to be a matching table. To do this you will first need to assign Minimum Hours/Execution Code Four to 99. Save the table, and then re-open it. Now you will see special matching preferences on the table.

Edit the properties of your matching table; giving it a description, tax ID number, entity ID, and assigning Tax Entity, Withholding Status and W2 Box preferences. Then set the Tax/Calculation Needs/Filing Status and Percentages/Limits fields to coincide with the specifications of your matching plan.

In the Linked Code field, enter the tax ID number from the existing table that you made note of earlier. This will ensure that the matching table is tied to the original existing table and calculates matching amounts correctly.

Save the table and then add it to employees as you would any other table/code.

(For larger Image: right-click-image & open in new tab)